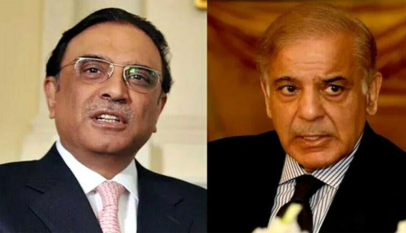

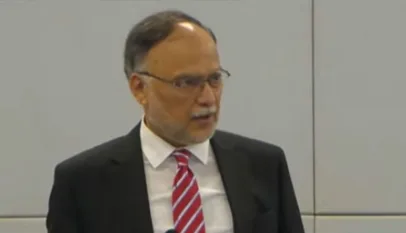

Prime Minister Shehbaz Sharif says the government has levied minimum tax on mediocre and poor segments of society in the fiscal budget 2024-25.

He was chairing a high-level review meeting in Islamabad today, on tax reforms, digitization of the economy and measures to increase revenues.

The Prime Minister said during the preparation of the budget, he gave clear directives that the elites must pay taxes.

Shehbaz Sharif said tax evaders, tax defaulters and their supporting elements will be nabbed.

He said complete digitization of tax system, increasing workforce efficiency; reducing the tax rate and increasing the number of taxpayers are among government’s topmost priorities.

The Prime Minister said Federal Board of Revenue is an important wheel of the country’s economy and government will provide all resources for development and digitization of FBR.

He said steps are being taken to bring the people eligible to pay tax into the tax net as soon as possible

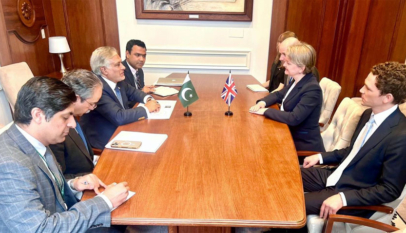

During the meeting, International firm McKinsey and Karandaaz apprised the Prime Minister of the progress made in the last four weeks regarding digitization of FBR and increase in revenues.

Short and medium term plans to enhance revenue were also presented to the Prime Minister.

The meeting was briefed that digitization and automation of the value chain of the country’s economy will increase revenues.