Special Investment Facilitation Council (SIFC) is endeavoring for introducing reforms in the Federal Board of Revenue (FBR), expanding the tax base, and implementing a robust track and trace system.

With the country’s tax collection potential estimated at twenty-four trillion rupees, the current target of nine trillion rupees highlights systemic challenges that must be addressed urgently.

Around two times the annual revenue target is being lost due to corruption, incompetence, and negligence within the system.

This substantial amount could have been utilized for repaying the country’s debts, constructing hospitals, schools, universities, and roads.

Recently, the World Bank and International Monetary Fund have also recommended improving Pakistan’s tax system to alleviate its financial burden.

Tax collection, deemed essential for government operations, is seen as crucial for driving socio-economic progress.

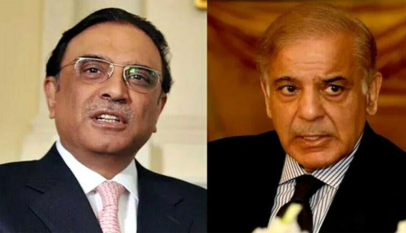

Prime Minister Shehbaz Sharif is keen for increasing tax revenue, and to ensure this, the SIFC stands hand in hand with the government at every step.