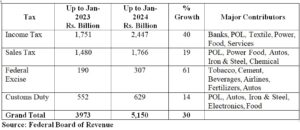

The Federal Board of Revenue (FBR) collected Rs.5.150 trillion since July 2023 to mid of February 2024 against Rs.3.973 trillion over the same period last fiscal year, showing growth of 30 percent.

During the course of this period, tax refunds grew by more than 28 percent, according to press statement issue by Finance Ministry here Tuesday.

Overall growth in the domestic taxes has been around 40%, while import duty and related taxes grew by 16% over July 2023 to January 2024 period. The growth in revenues gained momentum as GDP has revived and FBR collection has come under tighter scrutiny.

Notwithstanding, growth in import taxes fell largely due to downward adjustments in import tariffs over the years, and more recently restrictions on import licenses imposed by the State Bank of Pakistan (SBP) to contain balance of payments position in the wake of foreign exchange constraints.

The revenue collection from imports however incorporate the impact of the improvements in the valuation of imports that yielded Rs 151 billion collections as well as anti- smuggling drive that witnessed almost 69 % growth during the current fiscal year compared to last year.

According to the statement, there was scope to enhance anti-smuggling efforts by looking into increasing customs force in Baluchistan which has currently only 378 anti-smuggling staff compared to 20,000 personnel.

The statement termed the revenue mobilization from domestic taxes as a welcome shift, which was now over 64% of the total revenues collected during the current financial year. Concurrently the import taxes shared has declined to 36% from more than 50% just 3 years ago.

This revenue growth was predominantly driven by various sources of taxation. Income tax collections surged from Rs. 1,751 billion to Rs. 2,447 billion, marking a significant 40% increase. Major contributors to income tax included banks, petroleum and oil lubricants (POL) sector, textile industry, power sector, food industry, and various service sectors.

Sales tax collections also experienced notable growth, rising from Rs. 1,480 billion to Rs. 1,766 billion, representing a 19% increase. Key sectors driving this growth were the POL industry, power sector, food sector, automotive industry, iron and steel sector, and chemical industry.

Federal excise collections saw a substantial increase of 61%, climbing from Rs. 190 billion to Rs. 307 billion. This surge was primarily attributed to taxation on tobacco products, cement industry, beverages, airlines, fertilizers, and automotive sector.

Customs duty collections expanded from Rs. 552 billion to Rs. 629 billion, marking a growth rate of 14%. Major contributors to customs duty included the POL sector, automotive industry, iron and steel sector, electronics industry, and food industry.